Government plans to launch a new bank in 2024

The Department of Women, Youth and Persons with Disabilities (DWYPD) has applied to the Reserve Bank’s Prudential Authority to launch a new cooperative bank in South Africa.

Cooperative banks are different from typical commercial or even mutual banks and are more akin to formalised, registered and regulated stokvels.

A cooperative bank, part of the wider umbrella of cooperative financial institutions, is formed by a group of people who come together, take deposits, mobilise savings, and give out loans.

These groups differ from a stokvel because they are formalised, registered and required to meet certain criteria to operate. Because they are deposit-taking, they also need to register with the Prudential Authority.

Cooperative banks can operate at any level, but are limited in their products and services – such as foreign exchange.

These banks are conservative in nature and do not speculate with members’ money and invest in stock exchanges, etc – though they can go into secure funding and government bonds.

They also differ from mutual banks in that they operate under a common bond – either a group of people that work together or belong to a certain association or a certain geographical area.

Mutual banks require R10 million as a minimum capital requirement to start and do not require a common bond but are mutually owned and controlled by the members themselves.

A bank for the vulnerable

Presenting to the multi-party women’s caucus in parliament on Thursday (21 September), the DWYPD said it is moving forward with setting up a cooperative bank for the specific purpose of advancing the inclusion of women, youth and persons with disabilities and their businesses and other co-operatives.

More broadly, the bank would serve in the department’s mandate of ensuring that these vulnerable groups can take control of their own “financial destiny” and free themselves from abuse.

The committee said that similar models have been adopted in other countries, where such banks were able to provide financing and financial freedom for millions of women, in particular.

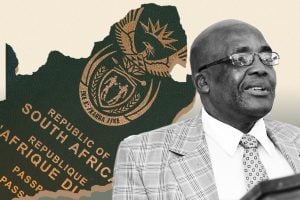

DWYPD minister Nkosazana Dlamini-Zuma stressed that the cooperative bank being proposed is not a state bank or government bank – although it is a government initiative.

She said that the plans for the bank were drawn up in cooperation with the Cooperative Banks Development Agency (CBDA) – an entity specifically set up for this purpose – to ensure that no mistakes were made.

“We are not just doing this as fly-by-night. We are following the legal prescripts. It’s not a government bank – it’s our (the government’s) initiative, but it’s not a government bank. It’s a co-operative bank that is owned and run by the members,” Dlamini-Zuma said.

“We are following the law very strictly,” she said.

To establish a cooperative bank, the law requires that co-operatives share a common bond, have a minimum of R100,000 in share capital and at least 200 members.

Members need to have R5 million in deposits and have to demonstrate that they have the financial, operational and human capacity to operate as a bank.

Because of these more stringent requirements, the Prudential Authority has higher standards and expectations when establishing such a bank, the department said.

According to the DWYPD, it meets the requirements.

Under the proposed name of the South African Innovative Financial Services (SAIFS), the department said there are 429 active members with R257,400 in shared capital, exceeding the minimum requirements.

It anticipates reaching 10,000 members and R5 million in deposits within 12 months of the date of the approval of the licence.

To this end, it has already submitted its registration package to the Prudential Authority (at the end of August 2023) and anticipates approval by the end of the year.

In terms of further implementation, if approval is granted, the ministry would officially launch the bank in January 2024, with operations commencing in July 2024 with savings and investments.

The caucus was generally supportive of the plans for the bank, but said that the committee needs to ensure that the setting up of the bank is in line with regulations and banking laws, while also making its purpose and operations clear.