Government wants to give Eskom and Transnet billions more

South Africa has begun discussions with the World Bank for a $1 billion (approx. R19 billion) loan to support Eskom’s transmission company and to upgrade Transnet’s railway infrastructure.

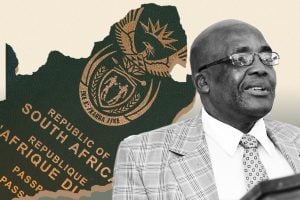

This is according to Deputy Finance Minister David Masondo, who told Business Day that “discussions about discussions” began on Thursday during the International Monetary Fund (IMF) and World Bank annual meetings in Morocco. He added, however, that there is no firm commitment yet from the global lender that the financing will be approved.

If these talks turn to fruition, South Africa and its taxpayers would be taking on loans it can’t afford for State-owned Enterprises that are failing.

As an overarching indicator of the mess SOEs are in and how much taxpayers have forked out to keep them alive, Public Enterprises Minister Pravin Gordhan revealed in a parliamentary Q&A this year that the government had provided R233.6 billion in bailouts for state-owned enterprises (SOEs) over the last five years and only received R1 million in dividends.

This means the government made a total return of -99.99957% on its investment, losing virtually everything it invested.

According to Gordhan, Eskom has already received R181.6 billion, excluding the R254 billion debt bailout for the next three years promised by Godongwana in February. Transnet has received R5.8 billion – which was given to fund the repair of infrastructure damaged by the floods in KwaZulu-Natal and the Eastern Cape and to maintain freight rail locomotives.

According to the two utilities’ financial results, Eskom is R423 billion in debt, while Transnet is sitting on R130 billion, serviced at a cost of R1 billion a month.

According to court papers submitted to the Gauteng High Court, following an application by political parties and civil society organisations to the court to force the government to end load shedding earlier this year, Eskom’s failings and power cuts have cost the country R1.2 trillion – equivalent to one-quarter of South Africa’s entire Gross Domestic Product (GDP).

In contrast, the collapse of South Africa’s rail and port utility, Transnet, is set to cost the country R1 billion a day in economic output, equivalent to 4.9% of annual GDP or R353 billion. This was revealed in a study by the GAIN Group, a boutique consultancy focusing on contract research of freight transport.

Despite the evidence of these SOEs’ collapse, Masondo’s comments to Business Day seem to show the government’s unwillingness to let go.

Masondo noted that the talks with the World Bank are “exploratory discussions about our pain points, as SA, on the capital requirements to get our network industries going.”

“For Transnet to invest in its freight rail infrastructure and port infrastructure, they need money, while Eskom also needs money for the establishment of its new transmission company, and unfortunately the fiscus does not have that money,” he added.

South Africa’s cumulative main budget deficit in the first five months of the 2023/24 fiscal year amounts to R238.4 billion, or R254.4 billion, including Eskom debt relief. This is much higher than the deficit of R160.7 billion in the same period in 2022/23. South Africa’s current debt-to-gross domestic product (GDP) ratio is 73%.

What’s worse, this deficit means that 20% of government revenue is spent solely on serving the country’s debt, and many economists warn this is set to worsen.

Masondo added, however, that “debt in itself is not a problem as long as the country is able to afford to service the debt … if the economy grows enough to service the debt, then the debt is not a challenge”.

However, the problem is that the country’s economy isn’t growing fast enough. Stats SA reported that the economy expanded 0.6% in real terms in Q2, compared to 0.4% in the first quarter. However, data from the mining and manufacturing sectors have also created fears over growth in Q3.

The IMF has raised its 2023 growth forecast for South Africa to 0.9% – up from its last forecast in July of 0.3% growth – due to lower-than-anticipated load shedding.

The IMF expects South Africa’s economy to grow by 1.8% in 2024. However, the local economy will continue to lag behind that of its African and developing peers, which are expected to grow, on average, by 4% and 4.1%, respectively.